On this page, you’ll find information about local, state, and federal funding opportunities and incentives available to individuals, businesses, nonprofits, and governments in eastern Oklahoma.

Quick Links

- Oklahoma Laws and Incentives can be found and filtered by fuel type and public/private funding sources

- Federal Laws and Incentives can be found through a comprehensive list of legacy programs along with recent incentives from the Bipartisan Infrastructure Law and Inflation Reduction Act

- Clean Cities & Communities Funding Opportunities reflect available funding that are similarly relevant to our coalition stakeholders

- DSIRE serves as a comprehensive information hub for renewable energy and energy efficiency incentives at the state and federal level. Access the hyperlink for additional Oklahoma-specific content

Latest Funding Announcements

Tax Credits

Federal

Clean Vehicle Credits

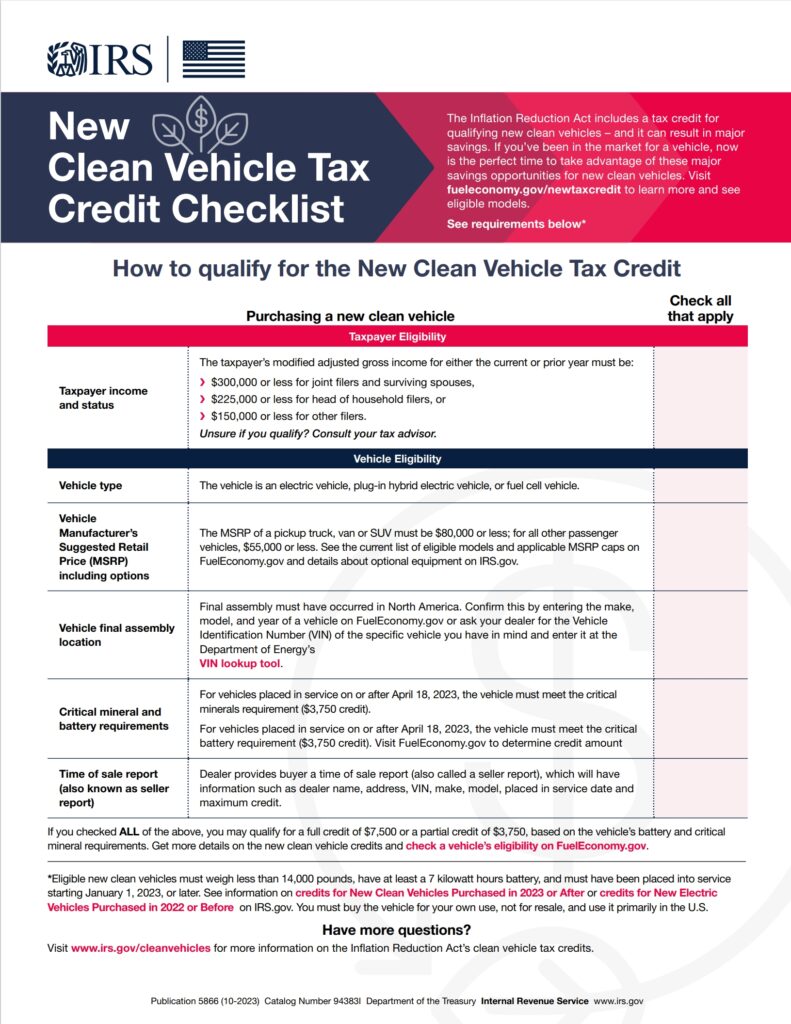

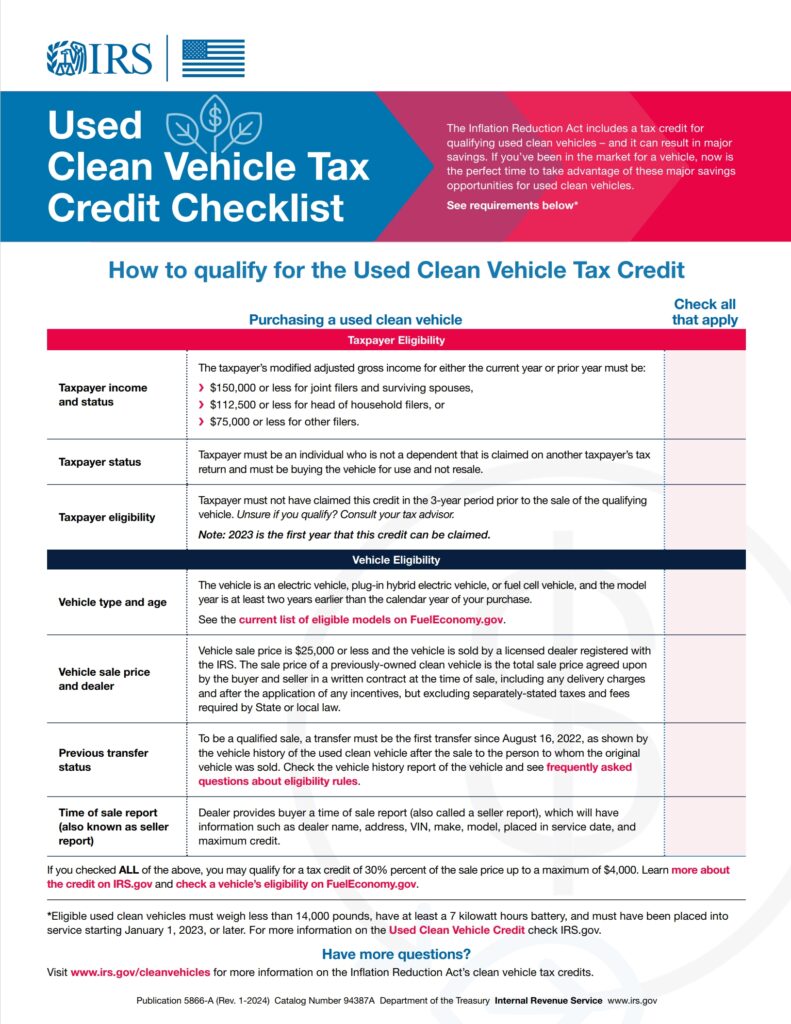

For NEW VEHICLES placed in service (delivered) in 2023 or after:

All-electric, plug-in hybrid, and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to $7,500 under Internal Revenue Code Section 30D. The credit amount will vary based on the capacity of the battery used to power the vehicle. The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032.

If you do not transfer the credit, it is nonrefundable when you file your taxes, so you can’t get back more on the credit than you owe in taxes. You can’t apply any excess credit to future tax years. For information on transferring a clean vehicle tax credit to a registered dealer in exchange for an equivalent reduction in the purchase price of the vehicle, check out this IRS fact sheet: https://www.irs.gov/pub/irs-pdf/p5900.pdf.

- The availability of the credit will depend on several factors, including the vehicle’s MSRP, its final assembly location, battery component and/or critical minerals sourcing, and your modified adjusted gross income (AGI).

- In accordance with new IRS regulations, beginning January 1, 2024, Clean Vehicle Tax Credits must be initiated and approved at the time of sale.

- Buyers are advised to obtain a copy of the IRS’s confirmation that a “time-of-sale” report was submitted successfully by the dealer.

Full details on eligibility and claiming the credit is available at https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after.

State

Considerations for Stakeholders

Important notes regarding Oklahoma’s Alternative Fuel Incentives

- Electric Vehicle Charging equipment must be “metered-for-fee” to be eligible for the tax credit

- Please read the regulations carefully and consult an attorney or tax professional before planning to utilize this credit for an EV charging project.

Oklahoma Alternative Fuel Tax Credit Forms

To apply for Oklahoma Alternative Fuel Vehicle and Infrastructure Tax Credit you will need the following forms.

- Required Form | You must fill out Form 511CR for each tax credit for which you are applying.

- Vehicle & Fueling Station Credits | To apply for vehicle credits and/or fueling station credits, you must fill out Form 567A.

Federal Alternative Fuel Tax Credit Forms

For the federal tax credit for selling alternative fuels for use in a motor vehicle, consult the following IRS pages:

- Part 4.24.2. Form 637, Excise Tax Registrations

- Claim for Refund of Excise Taxes (Form 8849)

- Form 8849 Schedule 3, Certain Fuel Mixtures and the Alternative Fuel Credit

When considering an application for a grant, reach out to us first so we can review and provide further assistance

Available Rebate Programs

Alternative Fuel School Bus and Electric Vehicle (EV) Charger Rebate

The Oklahoma Department of Environmental Quality (DEQ) offers rebates for projects that repower or replace an actively used, engine model year 2009 or older, diesel school bus with a model that operates on alternative fuel. Eligible alternative fuels and technologies include all-electric, propane, and natural gas. Applicants may receive rebates of up to 45% of project costs. Charging infrastructure for electric buses is eligible for funding, but is subject to a per-charger maximum and project cap. The program is funded by Oklahoma’s portion of the Volkswagen Environmental Mitigation Trust. Applications must be submitted through Oklahoma’s Clean Diesel Program. For more information, see the DEQ Alternative Fuel School Bus Program website.

Oklahoma Natural Gas CNG Rebate

The State of Oklahoma offers rebate program to promote CNG use in Oklahoma, funded through a 25-cent surcharge on each gallon of CNG sold at all public CNG dispensers owned and operated by Oklahoma Natural Gas. Visit ONG’s website for program updates, rebate applications, and more information.

Rebate Levels

- $2,000 for dedicated NGVs

- $2,000 for bi-fuel NGVs

- $3,000 for home fueling systems

Oklahoma Electric Cooperative Electric Vehicle (EV) Rebate

OEC offers a rebate of up to $300 for customers who own an EV. Eligible customers must own a Level 2 EV charger and schedule vehicle charging during off-peak hours. For more information, see the OEC Energy Efficiency Rebates website.

Oklahoma Gas & Electric (OG&E) Electric Vehicle (EV) Charging Rebate

OG&E offers a $250 rebate per charging port for residential customers. These rebates go towards the purchasing and installing qualified EV charging stations. Visit this page for more information.

East Central Electric Cooperative Electric Vehicle (EV) Charging Stations Rebate

East Central offers up to a $250 rebate for residential and commercial customers interested in purchasing qualifying Level 2 EV charging stations. For more information on this rebate program, visit this link.

Lake Region Electric Cooperative Electric Vehicle (EV) Home Charging Station Rebate

Lake Region offers up to a $250 rebate for residential and commercial customers interested in purchasing qualifying Level 2 EV charging stations. Visit their page for more information

Verdigris Valley Electric Cooperative Electric Vehicle (EV) Charging Stations Rebate

Verdigris Lake Region offers up to a $250 rebate for residential and commercial customers interested in purchasing qualifying Level 2 EV charging stations, limited to two per member location. For more information, visit this link.